The term " Deep Tech " refers to technology that are based on scientific or technological advances and have the future goal to be commercialized. These technologies include artificial intelligence (AI) and machine learning (ML). They also concern advanced manufacturing, biotechnology and nanotechnology, drones and robotics, photonics and electronics, cleanTech, space technology and life sciences. Deep Tech companies conduct research and development (R&D) and can be multidisciplinary.

Introduction : Deep Tech Financing

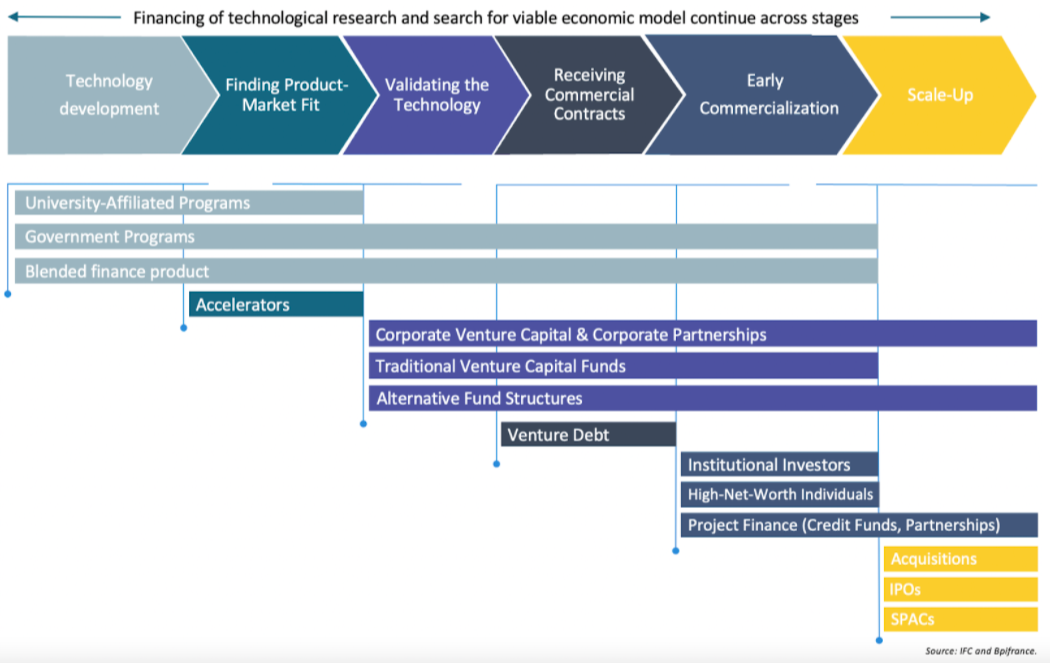

Deep Tech companies are attracting growing interest from venture capitalists (VC). Indeed, in 2020 an estimated $76.7 billion was invested across approximately 5,000 transactions. This momentum continues as nearly $78 billion was invested across some 4,000 transactions worldwide in the first 8 months of 2021. There are differences between financing « traditional » start-ups and financing of Deep Tech companies. In addition to higher risk, Deep Tech entrepreneurs face competing priorities and timelines (Figure 1). Stakeholders and investors perceive their investments as an opportunity to address a global scale challenge and not just to finance the development of a single project. This report analyses the financing mechanisms for deep tech companies, including the advantages and disadvantages of the financing options currently available. It also provides examples of promising but not yet widespread alternatives.

Technology development

To carry out their development, Deep Tech companies often require specialized R&D solutions, research laboratories or expensive infrastructure and equipment. Bringing a finished product to market can take years without the assurance of delivering the expected results. To allow companies to realize their technological development, Deep Tech companies first resort to non-dilutive financing set up by university or government programs. In addition to the opportunity to obtain funding for your company, having obtained non-dilutive funding from these institutions is an indication of the relevance of your development and will allow you to present your Deep Tech company to potential investors as a solution recognized by institutions.

- University-affiliated programs: By joining this program, companies could access research laboratory materials and networks of industrial experts. Generally, the programs are part of the technology Transfer Office (TTO) departments, in European countries, Deep Tech start-ups have the opportunity to cede a participation in order to benefit from the services attached to the program. In France, these programmes are called SATT (Technology Transfer Acceleration Companies). They provide a link between research laboratories and companies and finance the maturation and proof-of-concept phases of projects.

- Government programs: are not to be neglected, indeed, governments play a fundamental role in the establishment of Deep Tech at the pre-launch funding stage. For states, the contribution to the development of its industry is essential, that's why the funds allocated to companies are significant. In France, the public investment bank (BPI) has developed a Plan DeepTech program to meet the needs of start-ups. Created in 2019, the Plan DeepTech aims to encourage the creation and growth of French Deep Tech start-ups. To achieve this, the BPI wants to spread its €2.5 billion budget over a five-year period.

- Blended finance product: mixed financing consists of combining several types of financing to meet a capital need. A company can thus call upon debt, external capital, directly or indirectly, or even public capital. Mixed financing allows the company to retain more independence than a simple debt financing for example.

Finding Product-Market Fit

Before thinking about commercializing their finished products, Deep Tech start-ups must first focus on the feasibility aspect of their technology by taking into account the development timeline. The Technical evolution of the product is fundamental, but start-ups must simultaneously think about their future revenue model and the scaling of their innovation.

∙ Start-up accelerators: with their close relationships with the science and technology communities and specific industries, they are a critical source of funding for high-Tech companies seeking a product-market fit. In France, BPIfrance-owned EuroQuity20 platform has become a benchmark for connecting high-potential start-ups at all stages of their development with investors and business partners across borders in Europe. More than 30% of the companies that participated in its programs in 2020 and 2021 have raised funds, and 70% of those that did not are in the discussion phase.

Validating the technology

When the technology has been experimented within laboratories and the first market approach has been developed, a prototype needs to be made to test it under real market conditions. At this stage, one of the funding options for Deep technology lies in partnering with companies or raising money from a Corporate Venture Capital (CVC) fund.

In France, The Bourse French Tech and Paris Innovation Amorçage are grants that go up to €30,000. They can cover up to 70% of eligible expenses and the grant’s purpose is to participate in the expenses of young innovative projects directly linked to feasibility studies in some fields : technical, market, design, patentability.

For all disruptive innovation projects with a high technological content, qualified as Deep Tech, the Bourse French Tech Émergence finances up to 70% of the estimated eligible expenses, up to a maximum of €90,000. Its objective is to analyse the potential of a disruptive innovation project and its market prospects.

The deeptech development grant, or ADD, is the star device of the Deep Tech plan. It enables the financing of research and development expenses for a technology-intensive project (disruptive innovation). This aid takes the form of a mixed grant and a recoverable advance and can vary between €800,000 and €2,000,000 depending on the stage of the project.

Receiving Commercial Contracts

Once the entrepreneur has successfully completed the experimental project, Deep Tech can refine the technology and continue to develop commercial contracts while refining the unit economics or business model.

∙ Venture debt financing: For Deep Tech start-ups that have successfully structured a first round of fundraising, venture debt allows them to complement the capital they have previously raised.

Early Commercialization

If the traction for your product is starting to build through the accumulation of commercial contracts, it's time to accelerate your growth. However, Deep Tech start-ups developing innovative products often lack a startegy to boost sales. Indeed, the lack of a commercial startegy can scare investors. The French government has created a fund backedby institutional investors, to finance the best "French Tech" start-ups over three years at a budget of 6 billion euros in 2020.

Institutional investors: are investors often considered as long-term shareholders. They can invest several billion euros.

Sovereign funds: are public investment funds owned by governments. They are intended to put national savings to work by investing them in foreign financial markets.

High-net-worth individuals: are people with investable assets of at least $30 million. They comprise the world's richest people and control a huge amount of the world's wealth.

Scale-Up

Project finance: as a mechanism, it presents a range of funding solutions for Deeper Tech companies at a more mature stage, as commercial scale-ups require significant capital expenditures.

Deep Tech represents a major strategic challenge for the State, which has made its commitment to this innovation race concrete. The financing offer is rich, and the actors are abundant, the financing is a boost to the creation and growth of Deep Tech start-ups. It is important to keep in mind that the project is unique and therefore the financing path that will support it will also be unique. The temporality of Deep Tech projects makes them very capital-intensive. Financing needs are therefore substantial and spread out over time.